unified estate and gift tax credit 2021

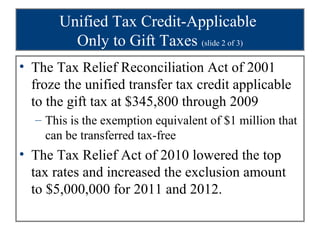

Gifts above the 16000 per giver amount will reduce the lifetime gift and estate exemption by the amount over 16000. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

What Is The 2021 New York Estate Tax Exclusion Rochester Ny Estate Planning Attorneys

The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person.

. What Is the Unified Tax Credit Amount for 2021. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure.

The unified tax credit is designed to decrease the tax bill of the individual or estate. For 2021 that lifetime exemption amount is 117 million. Your estate wouldnt be subject to the federal estate tax at all if its worth 1158 million or less and you were to die in 2021.

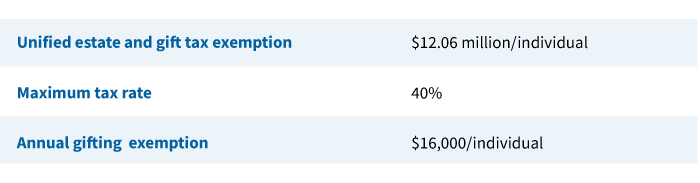

Beginning in 2022 the annual gift exclusion will be 16000 per doner up from 15000 in recent years. Gifts and estate transfers that exceed 1206 million are subject to tax. You can arrive at this number by subtracting 10 million from the BEA multiplying the result by 40 and adding 345800.

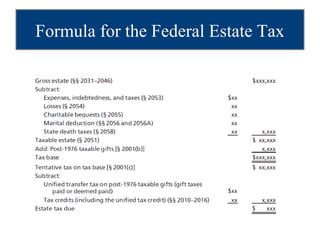

For purposes of completing a federal estate tax return Form 706 or gift tax return Form 709 the BEA is converted into a tax credit amount known as the Applicable Credit Amount. CT gift and estate tax is unified so that lifetime gifts deplete exemption available at death. This means that for many families estate tax liability isnt.

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due. The unified tax credit changes regularly depending on regulations related to estate and gift taxes.

The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed. This year they could give each child a combined 32000 without triggering the gift tax.

The federal estate tax exemption for 2022 is 1206 million. Unified tax credit strategies. The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person.

A key component of this exclusion is the basic exclusion amount BEA. A unified tax credit can reduce or eliminate your federal tax obligation while also integrating federal gift and estate taxes into one unified tax system. The size of the estate tax exemption meant that a mere 01 of.

The credit is first applied against the gift tax as taxable gifts are made. As of 2021 married couples can exempt 234 million. For 2022 the exemption increases to 1206 for individuals and 2412 for married couples filing jointly up from 117 million and 234 million respectively for 2021.

This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes being applied. For 2021 the estate and gift tax exemption stands at 117 million per person. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit.

The extent of the benefit provided by the unified tax credit depends on the tax year in which you intend to use the credit. Wednesday January 20 2021 The current federal unified estate and gift tax exemption of 117 million per person is set to automatically revert to approximately 6 million on January 1 2026. If you need more information about the unified tax credit use our free legal tool below.

Your gifts can total 30000 for the year if you want to give two people each the annual exclusion amount. FAQs March 16 2021. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF.

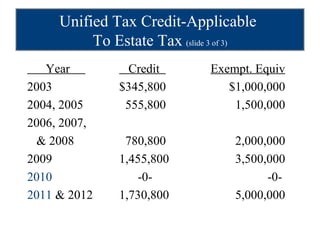

The Estate Tax is a tax on your right to transfer property at your death. Gift and Estate Tax Exemptions The Unified Credit. Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of.

The estate tax exemption is adjusted for inflation every year. Your estate tax exemption will be reduced if you made any taxable gifts during your lifetime that exceeded the annual exclusion from gift taxes 15000 in 2021. The unified gift and estate tax exemption is set at an inflation-adjusted 1206 million for 2022 up from 117 million for 2021.

How Might the Biden Administration Affect the Unified Tax Credit. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is. This is called the unified credit.

The unified credit is per person but a married couple can combine their exemptions. News November 29 2021. In the News 211 items Financial Planning.

The 117 million exception in 2021 is set to. In Revenue Procedure 2021-45 RP-2021-45 irsgov the Internal Revenue Service announced annual inflation-adjusted tax rates for 2022 including provisions concerning estate and gift taxes. What Is the Unified Tax Credit Amount for 2021.

Gift and Estate Tax Exemptions. The previous limit for 2020 was 1158 million. The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate tax.

In 2022 couples can exempt 2412 million. You can give up to this amount in money or property to any individual per year without incurring a gift tax. Exemption amount will increase to match the federal exemption in effect in 2023.

As of 2021 married couples can exempt 234 million In. The unified credit against estate and gift. The Unified Tax Credit represents the amount of assets that an individual is allowed to gift to other parties without having to pay gift estate or generation-skipping transfer taxes.

Then there is the exemption for gifts and estate taxes. Any tax due is determined after applying a credit based on an applicable exclusion amount.

Four Estate Planning Ideas For 2022

Estate Tax Law Changes What To Do Now

How To Make The Most Of The Annual Gift Tax Exclusion Isdaner Company

Tax And Financial Planning Strategies To Preserve Wealth

General Tax Guidelines About Gifting Thestreet

2021 Year End Tax Planning For Individuals Somerset Cpas And Advisors

What Are Gift Tax Rates And When Do You Have To Pay Gobankingrates

How To Prepare For Big Tax Changes

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Edelstein Company Llp Emerging Tax Alert What Do The 2021 Cost Of Living Adjustment Numbers Mean For You

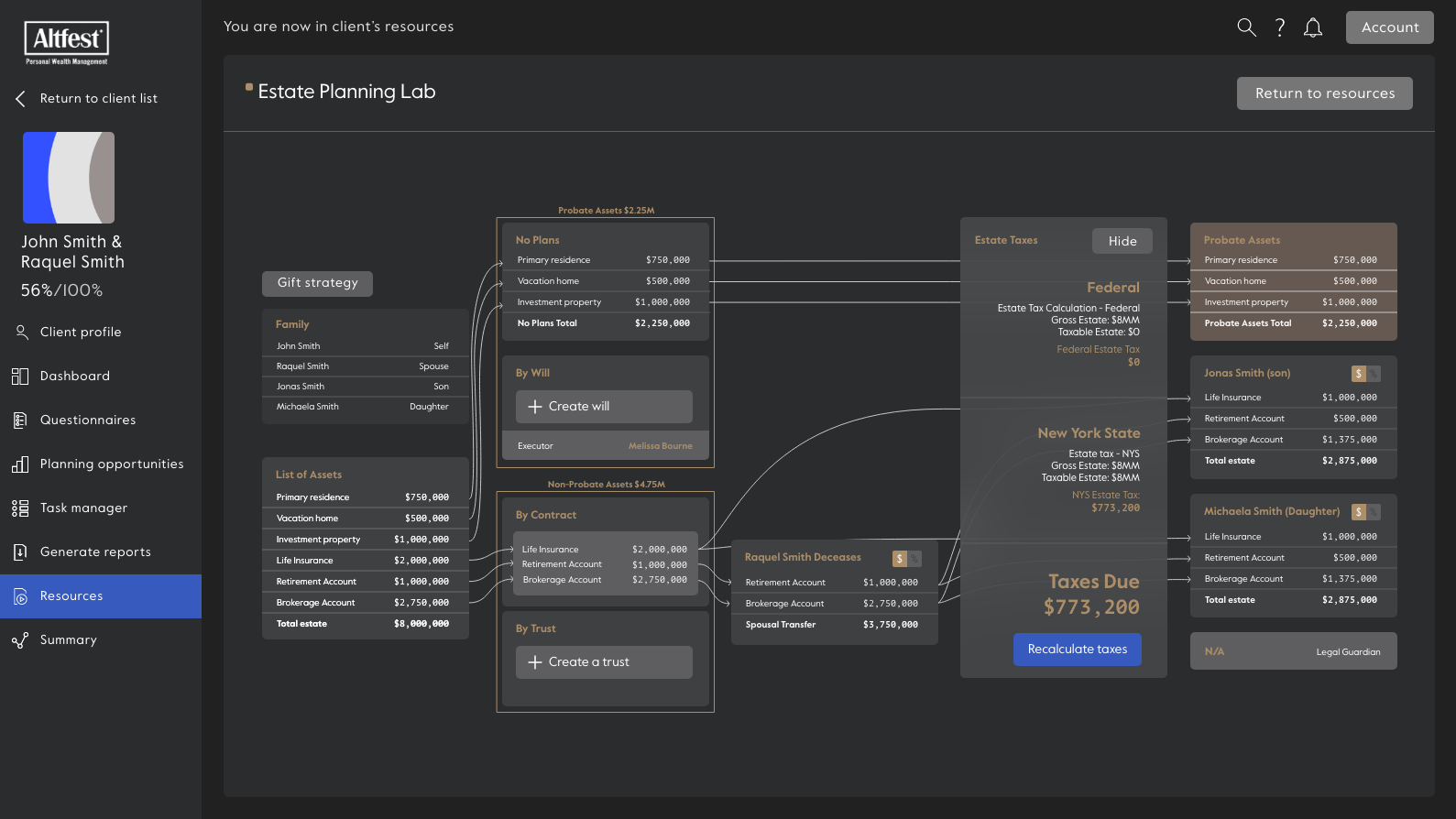

Planning Now For Greater Estate Tax Exposure Ny S Estate Tax Cliff Altfest

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

/money-for-you-172411636-fbc9ab4f707a49c08e17bc07f45f3f1d.jpg)