maryland tax lien payment plan

Maryland Judiciary Judgment and Liens Search. Check your Maryland tax liens.

Tax Lawyer Tax Attorney Represent Individuals Or Business With Different Problems Such As Tax Collection Problems Sale Debt Relief Programs Irs Taxes Tax Debt

You may use this service to set up an online payment agreement for your Maryland personal income tax.

. Ad Use our tax forgiveness calculator to estimate potential relief available. A payment agreement is very much like an IRS Installment Agreement. However if you cant pay your taxes you may be able to negotiate to get your lien.

Taxpayers wishing to pay off a tax debt through an installment agreement who owe more than 25000 are generally required to complete one. The registration fee is not applied toward the purchase of tax sale certificates. Alternative electronic check payment options are available through the office of the Comptroller of Maryland.

A non-refundable 15000 registration fee is required and a 100000 deposit. Send a check made payable to Baltimore County Maryland to. This electronic government service includes a serviceconvenience.

Taxpayers can apply for this program online or when responding to their. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. April 18 th 25 th May 2 nd May 9 th.

Select the appropriate radio button to search cases by Person or Company. Tax liens accrue interest rates as high as 20 in some counties. Taxpayers who owe past-due state taxes may be able to qualify for a.

Most taxpayers will be asked to repay the full balance. Default is person Person. Maryland tax lien payment plan.

Welcome to the Comptroller of Marylands Online Payment Agreement Request Service. The only surefire way to get rid of your Maryland tax lien is to pay your tax debt in full. Just remember each state has its own bidding process.

A Maryland tax payment plan may be available if you have a state tax liability that is beyond your means. Youll get the guidance. Created By Former Tax Firm Owners Based on Factors They Know are Important.

Request a payment plan from the. If you already have a tax lien taxpayers can set up a 60-month payment plan with. You can apply for a Maryland state tax payment plan by indicating that you need a payment plan when responding to your state tax bill.

Tax Payment Agreement If you owe the State of Maryland taxes and cannot pay one option is set up a tax payment plan. However for longer-term tax payment plans the Comptroller could file a. A tax lien may damage your credit score and can only be released when the back tax is paid in full.

For payment plans under six months the Comptroller will typically not file a lien against the taxpayers property. Ad See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

This is a very high interest rate. Anyone attempting to pay off a lien holder must pay them the interest as well. Generally if you dont have a lien you can get a 36-month payment plan with no financial required MD 433-A.

Payment can be made upon submission of your deed. If you have unpaid individual income taxes and are not in an approved payment plan you can request a payment arrangement online by email at mvaholdmarylandtaxesgov by calling the. Maryland tax lien payment plan Friday February 25 2022 First of all the IRS generally has up to three years from the date you file your tax return or are required to file your.

Pin By Incomeon On Rr L L Detox Your Home Real Estate Ads Detox

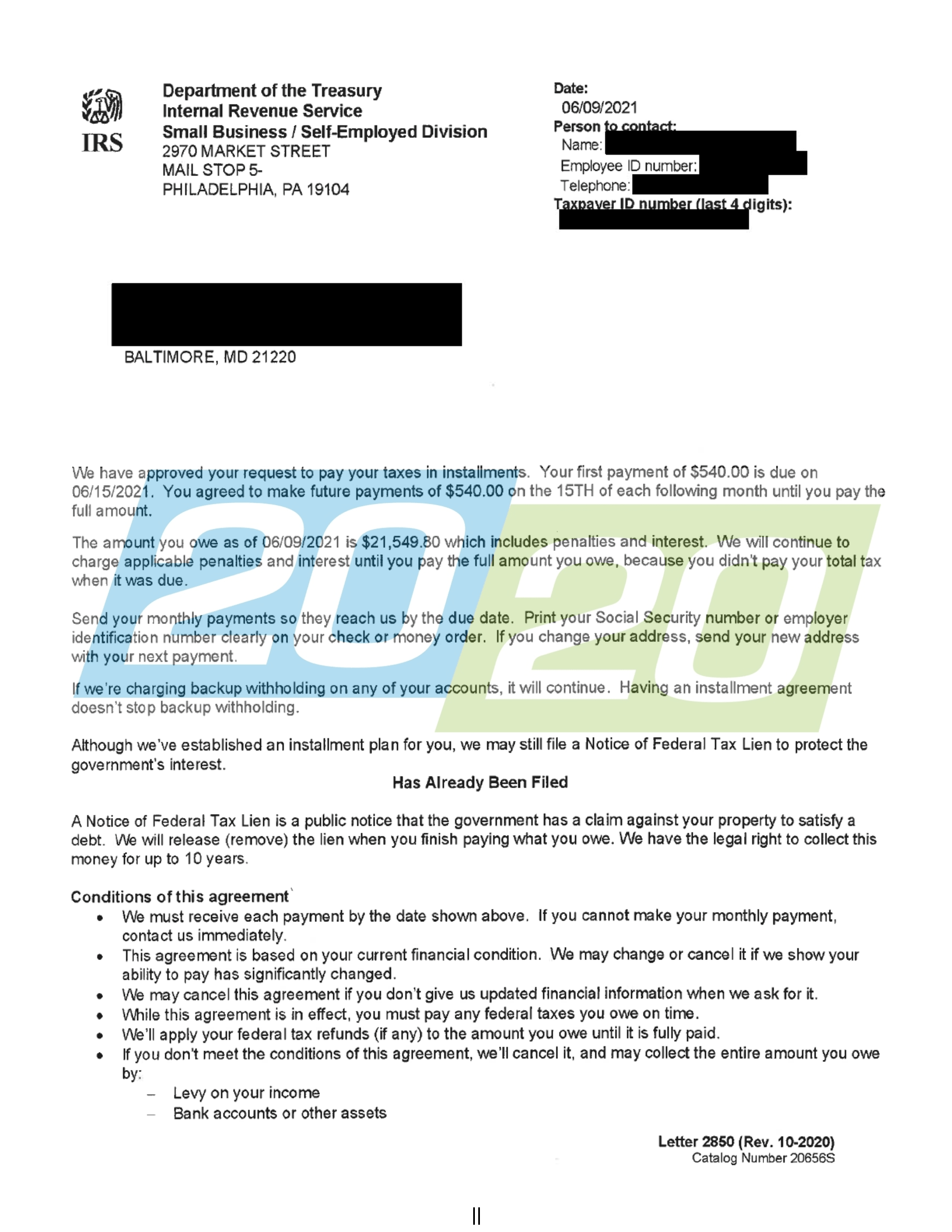

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

Tax Liabilities In Maryland Resolved 20 20 Tax Resolution

Maryland Tax Lien Amp Deeds Real Estate Investing Amp Financing Book How To Start Amp Fin In 2022 Business Books Graphic Design Business Writing A Business Plan

Frequency Content Creativity Your Value Proposition And You Value Proposition Estate Planning Attorney Marketing Program

How To Avoid A Maryland State Tax Lien

How To Buy State Tax Lien Properties In Florida Real Estate Get Tax Lien Certificates Tax Lien And Ohio Real Estate Arkansas Real Estate Florida Real Estate

Does Irs Debt Show On Your Credit Report H R Block

On The Couch Continued Positively Positive How To Plan Pinterest Branding Things To Sell

Maryland Comptroller And Irs Provide Tax Collection Relief In Response To Covid 19 Stein Sperling

Contact Strategic Tax Resolution Your Irs And State Tax Relief Experts Debt Relief Programs Debt Relief Tax Debt Relief

Maryland Tax Payment Plan Tax Group Center

Irs Accepts Installment Agreement In Glen Burnie Md 20 20 Tax Resolution

Passing The Torch Estate Planning Attorney Estate Planning Attorneys

Http Www Linkreaction Com Au Index Php Health Coaching Aging Fertility Age Health

It S Not The Home I Love But The Life That Is Lived Here Nexushomebuyers Knoxville Sellingrealestat Newlistings Pricechanges My House Home Home Buying

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

![]()

5 דרכים להכין מסיכת פנים ביתית נגד מחת הקורונה בא במייל תזונה ובריאות Estate Planning Content Marketing Estate Planning Attorney